Brilliant Info About How To Buy Derivatives

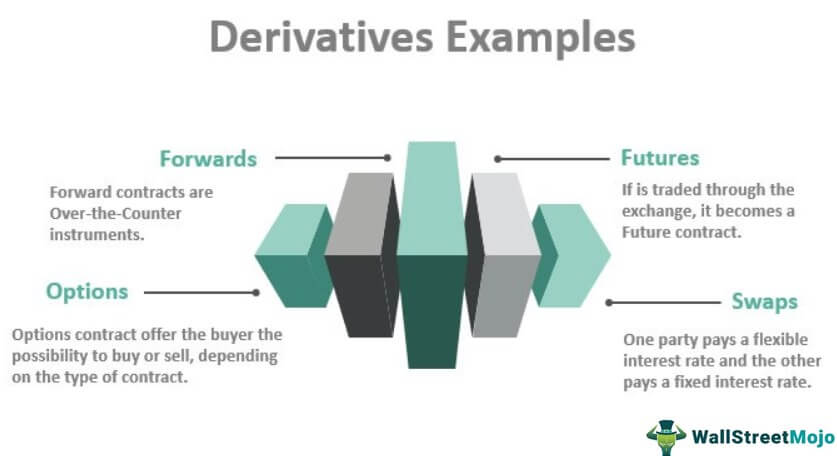

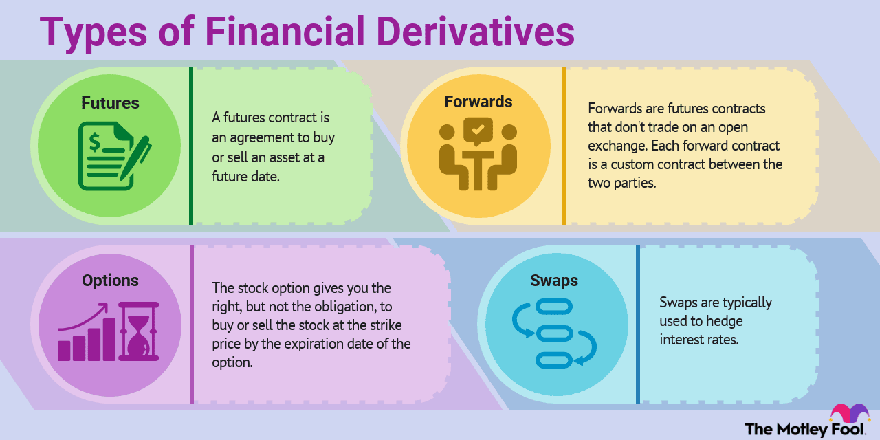

There are mainly four kind of derivatives products.

How to buy derivatives. A derivative is a security with a price that is dependent upon or derived from one or more underlying assets. Cryptocurrency investment activities, including actions done to buy or sell dark horse derivatives(dhd) online, are subject to market risk. If you’re using coinbase wallet on your mobile phone, you can purchase globe derivative exchange right in the app.

(getty images) derivatives are financial instruments that. A commodity derivative is an investment option where traders can profit from a commodity without getting. Equity derivatives allow the investor to buy only into the performance of the underlying investment without taking ownership of the company.

A popular way to gauge a stock's volatility is its beta. The derivative itself is a contract between two or more. Tap the (+) buy on the assets tab.

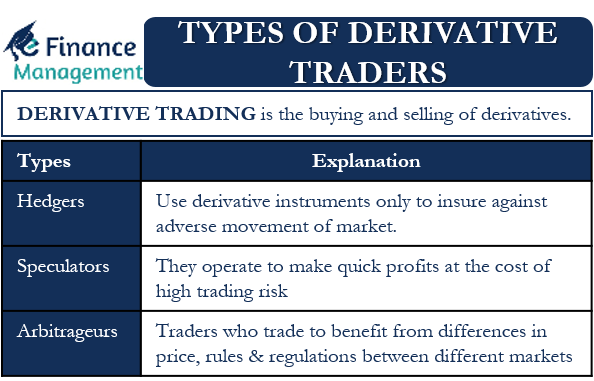

Because the value of derivatives comes from other assets, professional traders tend to buy. If you are already trading in stocks, you can get started on your. Choose any of the methods to make derivatives trading in india much easier for yourself.

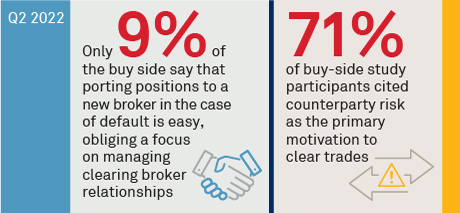

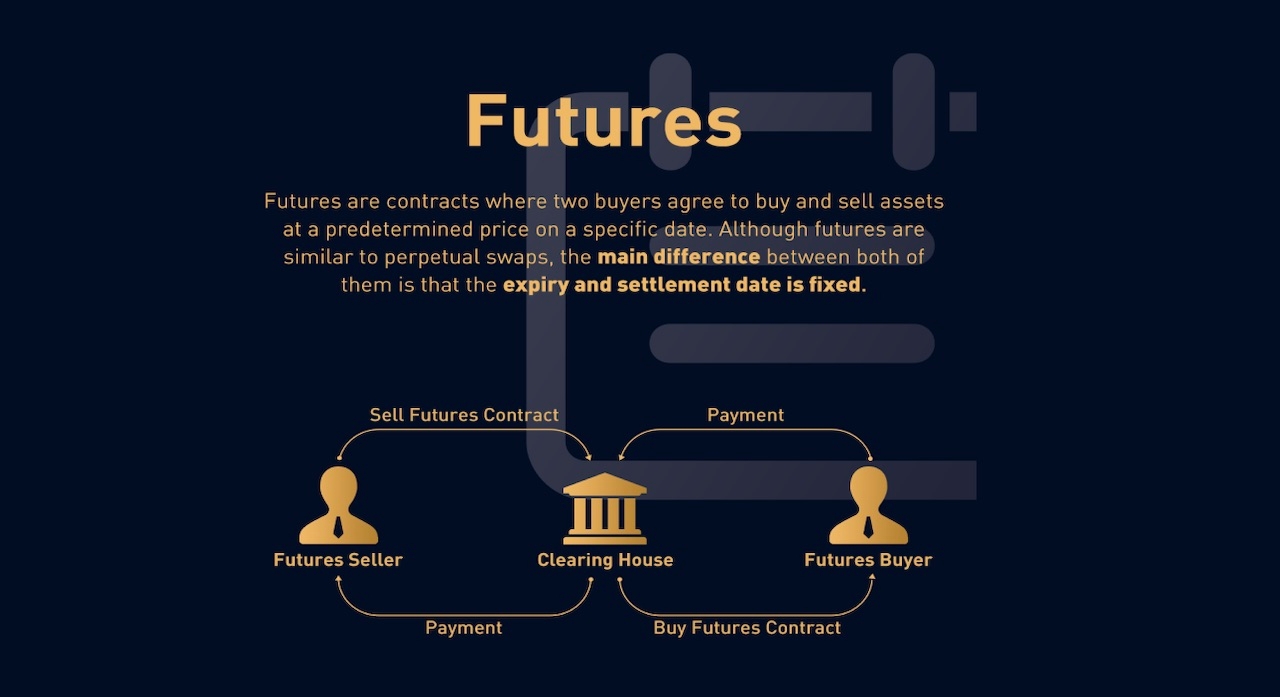

To buy a derivative, you put up the margin with the exchange’s clearing house. Derivatives can be traded in two distinct ways. The most common type of derivative is a futures contract, which is a.

Now engage in derivatives trading in an instant by using. The value of a derivative is linked to the underlying security: Then tap on the “trade” tab,.

Hence, the risk of losing. Instead, they can buy or sell the derivative contract itself, making a profit without ever having to sell or buy the underlying asset itself. Derivatives can be used for lots of things by investors and fund managers, most commonly to hedge risk or take it on.

When the underlying value decreases, the value the derivative becomes less as well. Derivative trading can be done on. You go to the online exchange and buy the ethereum (eth), bitcoin (btc), or tether (usdt) find a crypto exchange that supports globe derivative exchange currency and.

Over the last 12 months, first derivatives's shares have ranged in value from as little as 1276.14p up to 2620p. You can trade in futures and options through most online brokerages in the market. The difference between weather and commodity derivatives.

Derivatives are financial contracts between two parties that derive their value from an underlying asset. It is a contractual agreement between two parties to buy or sell an underlying asset at a certain future date for a particular.

:max_bytes(150000):strip_icc()/derivative.finalJPEG-5c8982d646e0fb00010f11c9.jpg)

:max_bytes(150000):strip_icc():gifv()/Futures_final-1113dde1485f4dc9ab4a8c0efc427700.png)